Virtual Fashion Shows: The Future of Runway Events?

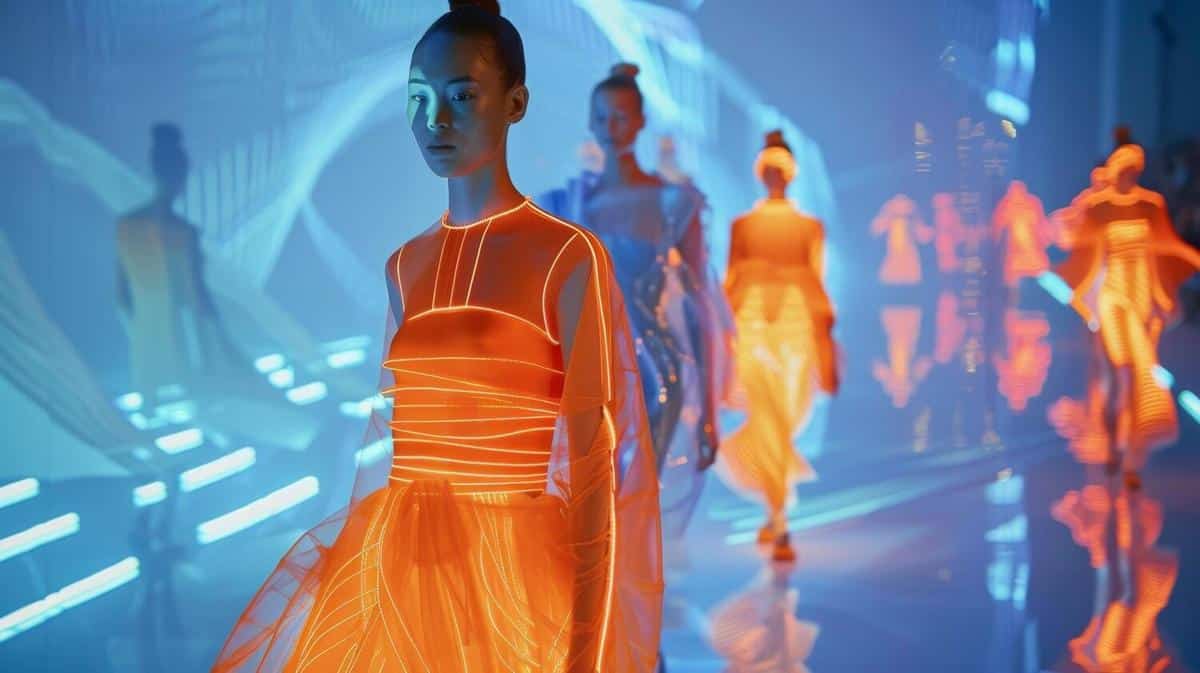

Picture this: a front-row seat to a dazzling fashion show, all from the comfort of your own home. Virtual fashion shows are rapidly reshaping the landscape of runway events, offering a blend of creativity and accessibility that traditional shows might struggle to match.

Virtual fashion shows have emerged as a dynamic and innovative alternative to physical runway events. With the increasing influence of digital technology, the fashion industry is embracing this shift with open arms, recognizing the unique benefits and opportunities it presents.

The Rise of Virtual Fashion Shows

According to a report by McKinsey & Company, the fashion industry saw a significant acceleration in digital adoption during the pandemic, with virtual shows playing a crucial role. Many designers have leveraged platforms like Instagram and TikTok to showcase their collections, reaching a global audience without the constraints of physical venues.

Expert Insights

Fashion expert and digital strategist, Rachel Arthur, notes that “virtual fashion shows are not just a response to current challenges but a glimpse into the future of fashion presentation.” This sentiment echoes the industry’s broader movement towards sustainability and inclusivity.

The Benefits of Going Virtual

- Accessibility: Virtual shows can reach a broader audience, including those who may not have the means to attend traditional shows.

- Cost-Effectiveness: Designers can save on venue expenses and logistics.

- Innovation: Digital platforms allow for creative presentations, such as augmented reality and interactive experiences.

- Sustainability: Reducing the need for travel and physical production aligns with eco-friendly practices.

Challenges and Considerations

While virtual fashion shows offer numerous advantages, they also present challenges. Technical issues and the need for robust digital infrastructure can be hurdles. Additionally, replicating the atmosphere and excitement of a live show is a challenge yet to be fully overcome.

Consider collaborating with tech experts to enhance the digital experience of your virtual fashion show. This can help in creating a seamless and engaging presentation.

Steps to Create a Successful Virtual Fashion Show

- Choose the Right Platform: Select a digital platform that aligns with your brand and audience.

- Invest in Quality Production: High-quality visuals and sound are crucial for engaging viewers.

- Promote Widely: Use social media and email marketing to build anticipation and reach a broader audience.

- Engage with the Audience: Incorporate interactive elements, such as live Q&As or virtual meet-and-greets.

Comparison Table: Virtual vs. Traditional Fashion Shows

| Aspect | Virtual Fashion Shows | Traditional Fashion Shows |

|---|---|---|

| Audience Reach | Global | Limited by location |

| Cost | Lower | Higher |

| Environmental Impact | Reduced | Higher |

| Interactivity | High | Low |

| Production Time | Flexible | Fixed schedule |

| Atmosphere | Virtual | Physical |

| Innovation | High | Moderate |

| Flexibility | High | Low |

FAQs

What are virtual fashion shows?

Virtual fashion shows are digital presentations of fashion collections, typically streamed online, allowing viewers to experience the show remotely.

Can virtual fashion shows replace traditional runway events?

While virtual shows offer unique advantages, they complement rather than completely replace traditional events, which provide a different kind of experience.

How can I make my virtual fashion show engaging?

Incorporate interactive elements, use high-quality visuals, and leverage social media to engage your audience effectively.

Conclusion

As the fashion industry continues to evolve, virtual fashion shows stand out as a powerful tool for designers and brands. Their ability to reach a global audience, reduce costs, and promote sustainability makes them a compelling option for the future. By embracing digital innovation, the fashion world can create experiences that are not only accessible and inclusive but also exciting and fresh.